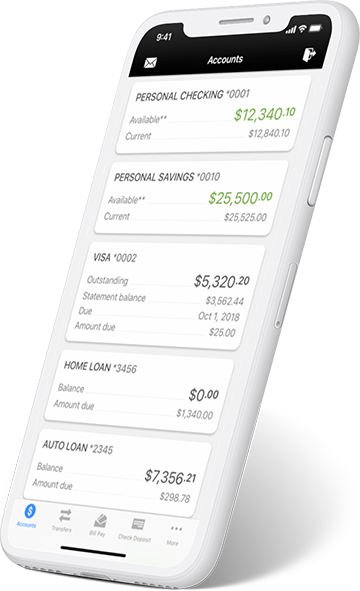

LBCU at Your Fingertips.

- Available to members enrolled in Online Banking

- Native iPhone, iPad, or Android apps are available