Check Out Our Auto Loan Rates Before You Go Car Shopping

Rates start at 5.49% APR*

Competitive rates to get you in your next vehicle.

*APR – Annual Percentage Rate. Rate is subject to change and based on creditworthiness. Rate of 5.49% listed is for a 36 month term. For every $1,000 borrowed at 5.49% APR for 36 months, you would pay $30.33. Not all applicants will qualify for the lowest rate.

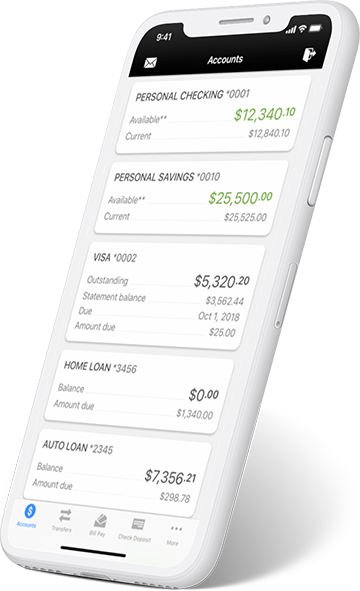

LBCU at Your Fingertips

- Available to members enrolled in Online Banking

- Native iPhone, iPad, or Android apps are available

- Depositing checks is as easy as snapping a photo with Remote Check Deposit

- Check your balances before you shop

- Easily make internal transfers and loan payments

- Pay your bills on the go with Bill Pay