Check Out Our Auto Loan Rates Before You Go Car Shopping

Rates start at 4.99% APR*

Competitive rates to get you in your next vehicle.

*APR – Annual Percentage Rate. Rate is subject to change and based on creditworthiness. Rate of 4.99% listed is for a 36 month term. For every $1,000 borrowed at 4.99% APR for 36 months, you would pay $30.70. Not all applicants will qualify for the lowest rate. A 0.25% Auto Pay Discount is available when you enroll in automatic payments from a qualified Liberty Bay checking account. The discount applies only while automatic payments remain active and in good standing. If Auto Pay is canceled or payments are returned for any reason, the interest rate and corresponding payment amount may increase by 0.25% The Auto Pay discount is not available on all loan types and may be subject to credit approval, loan amount and term restrictions. Other terms, conditions, and exclusions may apply. Please review your loan agreement for complete details. This offer may be modified or discontinued at any time without notice.

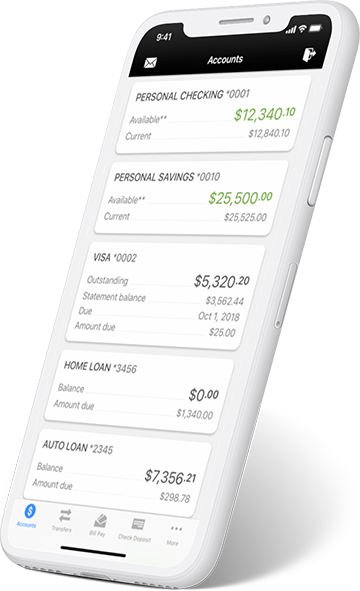

- Available to members enrolled in Online Banking

- Native iPhone, iPad, or Android apps are available

- Depositing checks is as easy as snapping a photo with Remote Check Deposit

- Check your balances before you shop

- Easily make internal transfers and loan payments

- Pay your bills on the go with Bill Pay